Role: I ran the project for over a year

Project goal

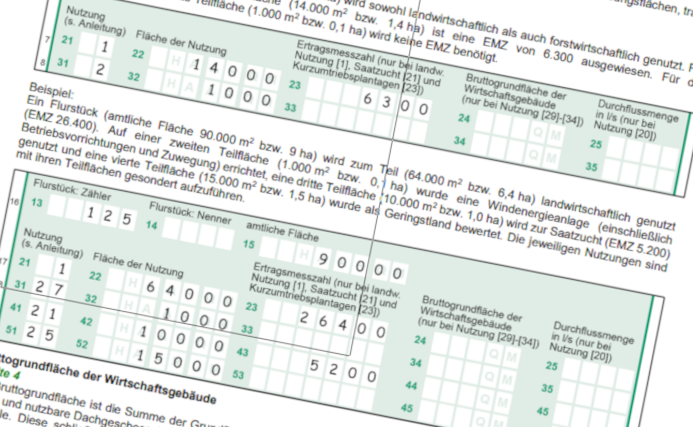

The German federal court decided that the existing property tax law was unconstitutional and so the government created a new law. They gave the tax office the task of requesting the needed information from the owners and then setting the new tax. The tax office made everything as difficult to understand as possible. They sent out letters that language experts derided as “the worst possible German” and designed forms that could only be understood by a detailed studying of the accompanying documentation – which was also not written in an understandable variety of German.

It was obvious that millions of people were going to run to their tax advisors and ask for help. The problem was that the advisors were already full trying to help their clients deal with all the other taxes that plague germans.

One tax advisor asked me to organize and run a project to deal with the expected rush of people needing help with their property tax declarations.

The advisor needed:

- to inform people that help was available,

- keep an overview of property tax clients,

- collate the needed information from the clients,

- research data available via various government interfaces,

- create the declarations,

- have the clients check and release the declarations with their signatures,

- send the declarations to the tax office.

Solution

Together we decided that the project was going to be run completely digitally. This agreed with the actual philosophy of the tax advisor and allowed us to implement new digital processes that could be used in other processes.

We extended the existing web page to include a section explaining property tax. We offered to help but also explained the information that we would need and where people could obtain this information. This allowed us to point clients to an extensive FAQ that answered many questions. A colleague was empowered as web manager to maintain the web pages.

We created an agreed upon process within the office that was documented and understood by all those involved in the project. We created a Wiki for the documentation that was quickly extended to document other processes and within six months became the standard knowledge repository within the office.

We activated the dormant ticket system within the offices IT system and used individual tickets to track the progress of each client and declaration. With multiple new items being created each day, this was vital to retain the overview of the entire project. Colleagues began to use the ticket system to organise their work load across the office and it became the central “todo” list.

We collected an active email address from every client possible and obtained their written permission to use that as the main form of communication. We only worked with digital information. If we received papers, these were immediately scanned and the originals returned to the client. All information was saved to the secure digital repository under the clients section.

We linked to existing digital government interfaces to obtain information needed. We applied for and received permission to digitally access government property data secured behind firewalls. The result was that we often knew more about a property than the owner themselves and occasionally surprised people by telling them that they actually owned more that they thought or that their partner was the real owner.

The declarations were created digitally using a software that we licensed for the period of the project. The software interfaced to the existing client database which avoided double data entry and could also be digitally “fed” with formatted data that we obtained from government databases. It ran plausibility tests throughout the process to identify potential problems and verified the declaration before release.

We implemented an e-signature software to send the finished declarations to the clients via email which allowed them to sign the release document digitally. One declaration was created on a sailing boat off Tasmania, released by the tax advisor in Switzerland after attempting an ascent of the Matterhorn and signed off by the client on his phone while on holiday. This system was immediately adopted throughout the office and within six months became the standard for client release of documents. The time and cost savings were and remain enormous and it provides additional legal security that allows proof of the documents that have been signed.

Finally the declarations were sent via the standard electronic interface to the tax office. Every transaction was verified with a system transaction code which was important when they falsely claimed that a declaration had not been sent. We could quote the time to the second that they received the document and their own verification code. No arguments or discussions were necessary.

The project ran sucessfully for over a year. While other tax advisors were turning away property tax requests, we were actively advertising that we could help. The project made a profit without negatively impacting other areas of business.

Most importantly, after the project was finished, we had implemented long term improvements that brought lasting benefits within the office:

- an internal web manager,

- an actively used and maintained Wiki as the central knowledge repository,

- a ticket system as a central “todo list”,

- more digital communication with clients via email,

- a digital e-signature release process for all declarations.